When our clients see Eurodollars futures being traded in their CTA accounts, they sometimes think that it is the Euro/USD currency pair. Eurodollars actually have nothing to do with Europe’s currency. Eurodollars are interest bearing bank deposits denominated in US Dollars and held at banks outside of the United States. Since these bank deposits are held outside the U.S., they are outside the jurisdiction of the US Federal Reserve, and subject to less regulation. Due to this, the higher level of risk to investors is reflected in higher interest rates.

Eurodollar Deposit Rate

The time interval eurodollar refers to U.S. Dollar-denominated deposits at worldwide banks or on the overseas branches of American banks. On account of they’re held exterior America, eurodollars are. Eurodollars are deposits of US dollars in banks outside of the United States – typically in Europe (hence the name). As the deposit is made outside of the US it escapes banking regulations from the Federal.

The Eurodollar Futures contract started trading on the Chicago Mercantile Exchange (CME) in 1981, marking the first cash settled futures contracts. When Eurodollar futures contracts expire, the seller of the contract can transfer the associated cash position rather than making delivery of the underlying asset.

What do Eurodollar futures measure? The underlying instrument in Eurodollar futures is a eurodollar time deposit having a principal value of $1,000,000 with a three-month maturity. Eurodollar futures provide an effective means for companies and banks to secure an interest rate for money it plans to borrow or lend in the future. The Eurodollar contract can be used to hedge against interest rate changes over multiple years into the future. If interest rates rise, Eurodollar futures decrease, and if interest rates fall, Eurodollar futures increase. Here is a current chart of December 2018 Eurodollar futures:

As you can see Eurodollars futures are currently trading around 97.40, which implies an interest rate of 2.60% in December 2018. If expected eurodollar interest rates in December 2018 were to rise to 3.60%, then December 2018 Eurodollars futures contracts would be trading down around 96.40.

As an interest rate product, the policy decisions of the US Federal Reserve have a major impact on the price of Eurodollar futures. Trading Eurodollar futures can be quite volatile around FOMC meetings and announcements. A long-term change in Fed policy towards raising interest rates would lead to Eurodollar futures declining steadily over the long-term (making it a good trade for trend followers).

The Eurodollar futures contract is one of the largest and most successful interest rate-based contracts.

Eurodollars should not be confused with the currency of the European Union which is known as the euro. A Eurodollar and a euro are not the same thing.

Eurodollar is a term that refers to any United States dollar (“U.S. dollar”) held outside the U.S. banking system. In other words, there can be Eurodollars in the UK, the UAE, Brazil, Burundi, etc. They can even exist in the United States if held in a branch of a foreign bank. The term is not determined by geographical location.

After World War II when recovering economies gradually began to accumulate onto U.S. dollars, some countries preferred not to repatriate U.S. dollars through U.S. banks, but instead held them “off-shore”, primarily in London-based banks out of the reach of the United States government.

Over time, a bank lending market grew up around this pool of funds.

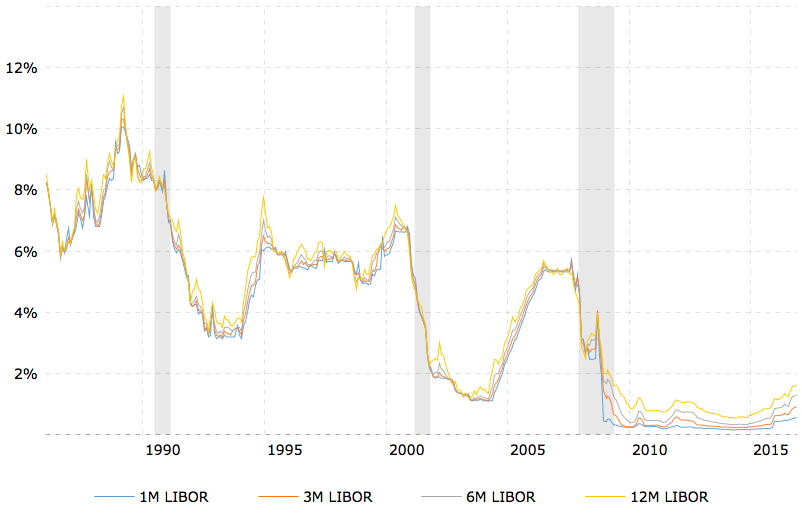

British bankers began referring to the lending rates in this market as the London Inter-Bank Offer Rate, also known as ICE LIBOR.

ICE LIBOR has grown into a set of rates across the length of the yield curve from overnight to twelve months.

Eurodollar futures at CME Group are based on the three month ICE LIBOR underlying rate and listed under the March quarterly cycle for 40 consecutive quarters, plus four serial contracts at the front end of the curve.

Eurodollars are financially settled products, and expire on the second business day that precedes the third Wednesday of each contract month, which is usually a Monday.

Eurodollars Are Primarily Used In

Summary

Eurodollar Bonds

Eurodollar futures contracts are used by a wide array of users, from banks to proprietary trading firms and commercial businesses to hedge funds.

Eurodollars Cyberpunk

So, if you have U.S. dollar market exposure, Eurodollar futures can help manage your risk.