By Rachel Mortimer

The Financial Services Compensation Scheme has extended its protection for consumers with temporary deposits of up to £1m amid concerns surrounding access to banking services in the aftermath of the coronavirus crisis.

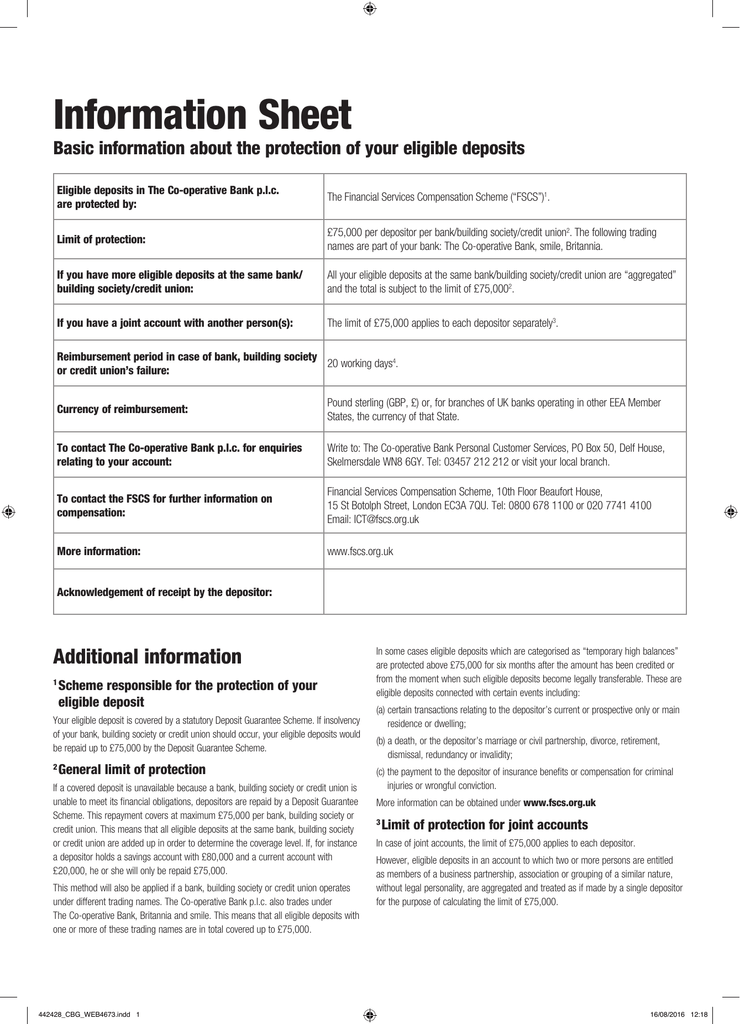

About FSCS FSCS is here to protect your money. It is the body which gives you automatic protection up to £85,000 if your bank, building society or credit union goes out of business; and you’ll normally get your money back within seven days. FSCS is funded by the financial services industry and is free to. The FSCS - Financial Services Compensation Scheme. The Financial Services Compensation Scheme (FSCS) is the compensation fund of last resort for customers of authorised financial services firms. If a firm is in default or ceases trading the FSCS may be able to pay compensation to its customers. Read on to find out what FSCS protection is, what the coverage limits are for your savings, and how you can actually make a claim. What is the FSCS? The tongue-twisting FSCS stands for Financial.

Fscs Protection Limit

- 1 day ago “FSCS’s protection increases consumer confidence when buying financial products and services, and our compensation helps put customers back on track if firms should fail”.

- There are three ways that we can protect eligible customers of failed insurers: 1. If the policy is replaced by a new policy with a different insurer, we can pay the new insurer towards the cost of this.

Later this week the financial lifeboat body will temporality increase the length of time for which it will protect temporary high balances of up to £1m from six to 12 months.

The protection will apply in scenarios where deposit-takers fail handling temporary balances such as funds deposited in preparation for buying a main residence, those paid in relation to a divorce, redundancy payout or compensation when someone dies.

The extension will only apply to deposit-takers which fail after August 6, when the extra protection comes into force.

Caroline Rainbird, chief executive at the FSCS, said: 'The coronavirus pandemic has been very worrying for everyone, and people are understandably concerned about the possibility of losing their temporary high balance should their deposit taker fail.

'The temporary extension of FSCS's protection from six to 12 months will do much to reassure them should the worst happen during these uncertain times.'

The FSCS said the move comes in response to the impact of Covid-19 on the residential property and investment markets, with some consumers facing reduced access to banking services.

Where a deposit-taker fails after August 6 the extension will apply to both new and existing temporary high balances received.

Funds deposited into an account with an authorised UK bank, building society or credit union in February 2020 - with the six-month coverage due initially to end in August 2020 - will now be protected until February 2021.

The levy which funds the FSCS has hit the headlines in recent weeks, with some advisers warning its increasing bill could force them to increase their fees in an attempt to balance the books.

It comes amid frequent concerns raised by the industry that the current levy set-up means the 'polluter' often fails to pay for consumer compensation, with firms remaining in the industry left to pick up the bill.

rachel.mortimer@ft.com

Fscs Protection

What do you think about the issues raised by this story? Email us on fa.letters@ft.com to let us know.

If you paid for cover with an insurer that has become insolvent, we may be able to compensate you. This is subject to conditions, limits and requirements set out by the Prudential Regulation Authority (PRA) in their rulebook.

To be eligible for protection, the company that failed must have been regulated by the Prudential Regulation Authority (PRA).

How we protect customers

There are three ways that we can protect eligible customers of failed insurers:

1. If the policy is replaced by a new policy with a different insurer, we can pay the new insurer towards the cost of this.

2. If the policy is not replaced and eligible customers are entitled to the remaining portion of their insurance policy premium, we fund and process this payment. Please note:

- The rules we follow say that we can only repay 90% the refund that is calculated

- If the insurance policy is in your name, but you paid for it with a loan from a finance company that required you to assign your rights to them, we will pay any return of premium payments to the finance company directly.

3. If policyholders have valid claims under an insurance policy with a failed insurer, which meet our conditions for eligibility, we pay either 90% or 100% of the claim value to eligible policyholders. Please see below for detail on compensation for different insurance types. This information is accurate as of December 2020.

The following insurance claims are entitled to 100% compensation. That means that if the insolvency practitioner accepts them, we will repay them in full:

- Third-party motor

- Employers’ liability

- Whole of life assurance

- Term life insurance and/or critical illness insurance*

- Insured personal pensions*

- Annuities*

- Income protection insurance – also known as permanent health insurance or long-term disability insurance*

- Professional indemnity insurance*

- Claims arising from the death or incapacity of a policyholder due to injury, sickness or infirmity (e.g. a death or disablement benefit of a personal accident policy or similar benefit on a motor policy.) *

- Building guarantee policies for firms that failed on or after 8 October 2020. Prior to this, 90% of the value of eligible claims will be repaid.

* If the firm failed on or after 3 July 2015. If before, claims are 90% protected.

The following insurance claims are entitled to 90% compensation. That means that if the insurer’s IP accepts them, we will repay 90% of their value:

- Motor first party

- Pet

- Travel

- Home

- Dental

- Health

- Warranty

- Public liability

- Property

The following insurance claims are not eligible for FSCS protection:

- Goods in transit

- Marine

- Aviation

- Credit insurance

- Contracts of reinsurance for insurance firms or brokers / financial advisers

Find out more about what happens when an insurance company fails, or who gets involved in insurance failures.

Insurance

Other insurance

Find recently failed insurance companies by typing a name into the search box on the Find firms page.

How long will it take?

See how long it takes to typically process insurance claims.