Santander Bank has over 600 branches in the Northeast. It offers a range of checking and savings accounts, with simple requirements to waive service fees.

Santander Bank Promotions

Santander Bank frequently offers cash bonuses for new checking customers. Some deals are only available for residents of select States, so make sure you read the fine print carefully.

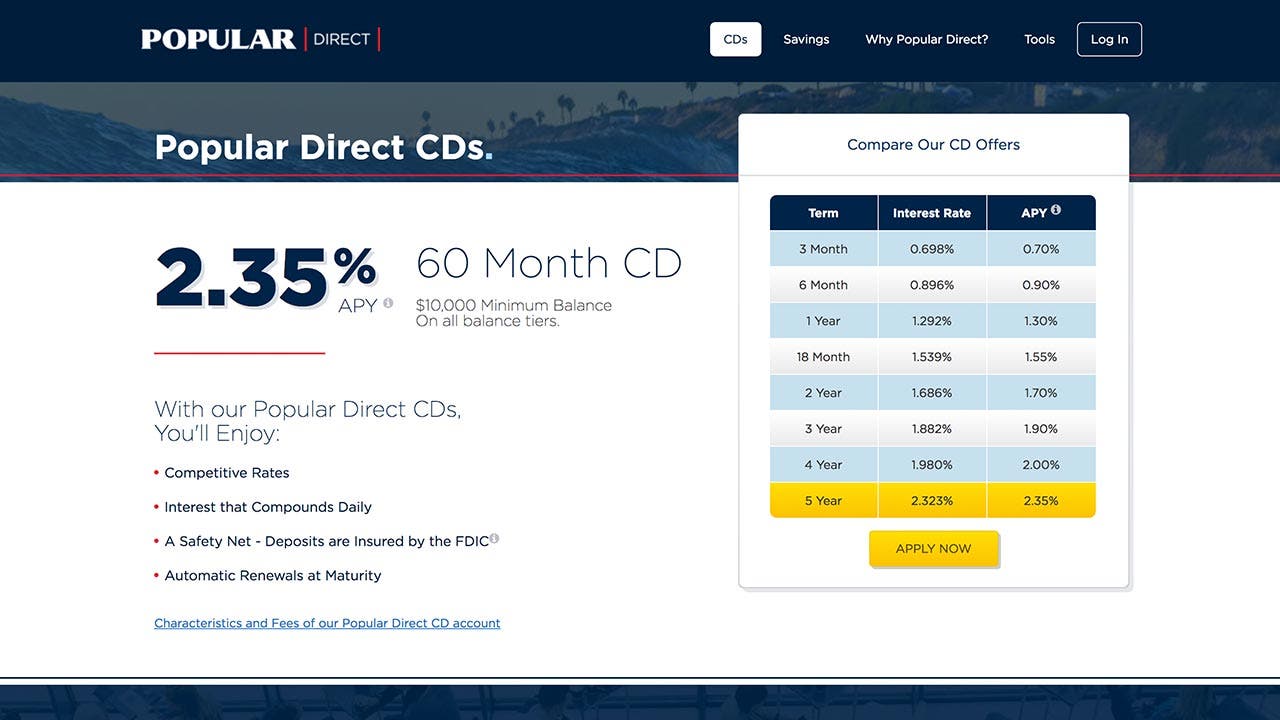

- Sovereign Bank 3 Year CD Rates: 2.30%. Santander 15 Year Fixed Rate Home Loan: 2.5%. Santander 15 Month CD Rates: 2.05%. Santander 30 Year Fixed Rate Home Loan: 3.25%.

- The terms, interest rates, and APYs above are for statement-based CDs only. Passbook-based CDs are available, but terms, interest rates, and APYs may be different. Please visit a branch for more information. Preferred Checking Account customers are entitled to an additional 10 basis points (0.10%) on CDs. APY refers to Annual Percentage Yield.

- Please note that the current interest rate below is determined from the 3 Yr CD rate. The rate of 2.30% is 1.17% higher than the average 1.13%. Also it is 0.25% lower than the highest rate 2.55 Updated Aug.

All Santanders Bank checking accounts offer free online banking, bill pay, and mobile deposits. There are over 2,000 ATMS throughout the Northeast.

Find the best CD rates by comparing national and local rates. A Certificate of Deposit is a. Opening a fixed-rate CD is a bad idea when market interest rates are increasing, since you risk locking yourself into a low rate for an extended period of time, especially for longer-term CDs.

Special Checking Account Features

Santander checking accounts come with these features:

- Instant Card Hold. This allows you to temporarily lock your debit card. You can control it on your mobile app and the hold goes into effect immediately. This is great if you lost your card and need time to look for it, or if you simply want to control your spending. When you've found your card, you can release the hold.

- Overdraft Protection. Santander Bank offers two ways to protect against overdrafts. You can link a savings or money market account and funds will be transferred to cover the overdrawn amount. Or you can apply for an Overdraft Line of Credit. There is a transfer fee (though it's a lot less than the overdraft fee).

- Free savings account. You get a Santander Savings or Santander Money Market Savings account for no monthly service fee with any checking account.

Santander Cd Rates

What to Open at Santander Bank

Santander Cd Rates For Ma

- Certificate of Deposit. Santander Bank offers highly competitive rates for their term CDs. Terms go from 3 months to 5 years. The minimum deposit to open is $500.

- Simply Right Checking. It's easy to waive the monthly fee just by using this account at least once a month. And there are no account balance requirements. You also get a free Santander Savings or Money Market Savings account. The minimum to open is $25.

- Student Value Checking. This account is free for students 14-25. There are no minimum balance requirements. The minimum to open is $10.

Santander Cd Rates Ri

How to Avoid Santander Bank Checking Account Fees

- Basic Checking. This account has no minimum balance requirements, but the $3 monthly fee cannot be waived. The minimum to open is $25.

- Simply Right Checking. The $10 monthly fee can be waived if you make just one transaction per month (a deposit, withdrawal, transfer, or payment).

- Premier Plus Checking. The $25 monthly fee can be waived if you: maintain a combined balance of $25,000 in Santander deposit and eligible investment accounts, OR have direct deposits of at least $4,000 per month.

- Student Value Checking. This account has no monthly service fee and no minimum balance requirements for students 14-25. The minimum to open is $10.